2026 Healthcare Coverage Options: What Each Really Offers (and What to Confirm Early)

For 2026, many people are comparing ACA Marketplace plans, employer coverage, Medicare, short-term products, and membership-based primary care models. This guide explains what each option really is, what protections come with it, what to confirm before you enroll, and the key dates and cost ceilings that matter for 2026. Educational only; not legal, tax, or medical advice.

If you’re shopping for 2026 coverage, you’re not just choosing a premium. You’re choosing a set of rules: what the plan must cover, how it can treat you, and how much financial protection you truly have.

Below is a clear guide to the major categories people consider in 2026, plus a simple way to build stability regardless of what changes in the system.

If you want a healthcare experience built around time, continuity, and coordination, The Cove Concierge Medicine can be the stable primary care layer in your plan. Start here:

Key 2026 facts to know before comparing options

1. Open Enrollment timing

HealthCare.gov notes Open Enrollment ends January 15 for 2026 coverage. If you enroll by January 15, coverage starts February 1.

Colorado note: Colorado runs its own Marketplace (Connect for Health Colorado). Their site also notes Open Enrollment ends January 15, 2026.

2. Marketplace out-of-pocket maximum ceiling

HealthCare.gov states that for the 2026 plan year, the out-of-pocket limit for a Marketplace plan can’t be more than:

· $10,600 for an individual

· $21,200 for a family

3. New 2026 HSA-related information (confirm details for your situation)

HealthCare.gov states that more 2026 Marketplace plans, including all Bronze and Catastrophic plans, now work with Health Savings Accounts (HSAs) when you’re enrolled in an eligible high deductible health plan.

IRS guidance for 2026 HSA limits

The IRS states that for calendar year 2026, the annual HSA contribution limit is:

· $4,400 for self-only coverage

· $8,750 for family coverage

(Eligibility rules apply; confirm with your tax professional.)

A practical decision framework

Ask two separate questions:

1. What protects my finances if something expensive happens?

2. What ensures I can actually access care reliably day to day?

Insurance primarily answers the first.

Primary care models (like concierge) primarily answer the second.

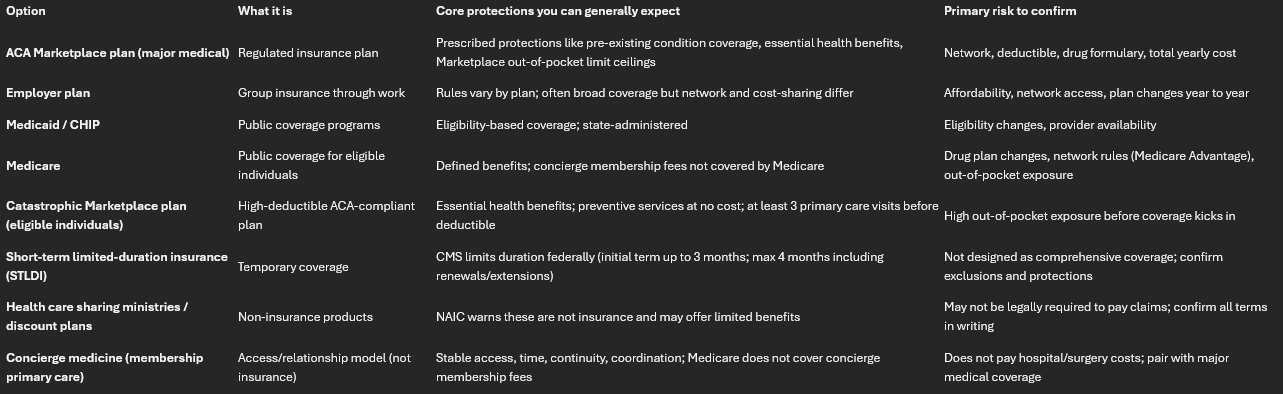

Healthcare options table.

How to build a resilient 2026 plan (without overcomplicating it)

Step 1: Secure major medical coverage if at all possible

This is your financial protection layer. For many people it’s Marketplace, employer coverage, Medicare, or Medicaid/CHIP.

Step 2: Secure stable primary care access

This is your experience layer. Insurance doesn’t guarantee timely visits, longer appointments, or continuity.

If you want a steady, relationship-based primary care home in Colorado, schedule a Meet + Greet with The Cove

Step 3: Confirm the details that actually drive real-life outcomes

Before you enroll, confirm:

· Network: are your preferred clinicians and facilities in-network?

· Total yearly cost: premium + deductible + expected out-of-pocket

· Out-of-pocket maximum and what counts toward it

· Plan notices and re-enrollment letters (HealthCare.gov notes you may receive these)

A final note on timing

If you wait until the last days of Open Enrollment, you reduce your choices and increase stress. HealthCare.gov notes January 15 is the last day of Open Enrollment for 2026 coverage, with coverage starting February 1 if you enroll by that date.

If you want a consistent care team before the year gets busy, now is a great time to explore The Cove membership.

Educational only; not legal, tax, or medical advice.